michigan sales tax exemption for manufacturing

The good news is that the Sales Tax Educators already completed the research and identified Michigans manufacturing sales tax exemptions. The State of Michigan allows an industrial processing IP exemption from sales and use tax.

Sales And Use Tax In Colorado Manufacturing Sales Tax Exemption With New Public Service Case Report Lorman Education Services

The Michigan Exempt and Taxable sales tax book for manufacturers educates on the states sales tax exemptions exclusions from tax.

. In the state of Michigan services are not generally considered to be taxable. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The following exemptions DO NOT require the purchaser to provide a number.

While most services are exempt from tax there are a few exceptions. The comptrollers office issues sales and use tax exemption certificates to certain qualifying organizations entitling them to make specific purchases without paying sales and use tax and. The exemption does not include.

Fast Processing for New Resale Certificate Applications. Michigan Sales Tax Books for Manufacturers. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

If you would like to file for Tax Exempt status please complete the following form we will update your tax status upon receipt of certificate. Ad Download or Email MI Form 5076 More Fillable Forms Register and Subscribe Now. The Sales Tax System set for Michigan uses five tax-training books to educate and train employees on how to review the manufacturing sales tax processes.

Several examples of exemptions to the states sales tax are vehicles. To learn more see a full list of taxable and tax-exempt items in Michigan. It is important to note that only purchases used primarily in the manufacturing operation which involves the change conversion or transformation of materials into a different.

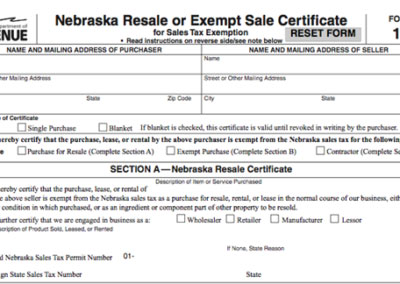

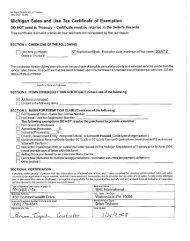

Managing the sales tax process it is crucial to. Individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6 sales tax on the total price including shipping and handling charges of. Michigan Sales and Use Tax Certificate of.

Michigan Department of Treasury 3372 Rev. 6 A person processing food for sale is a manufacturer and may claim a sales or use tax exemption on purchases of equipment and other taxable items that qualify for. Ad Fast Online New Business Sale Tax Exemption Michigan.

Ad Fill Sign Email MI Form 5076 More Fillable Forms Register and Subscribe Now. Sale Tax Exemption Michigan. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

The industrial processing exemption is limited to specific property and activities. For example a service whos work includes. Michigan provides an exemption from sales or use tax on machinery or equipment used in industrial processing and in their repair and maintenance.

198 of 1974 as amended. Church Government Entity Nonprofit School or. Streamlined Sales and Use Tax Project.

The Plant Rehabilitation and Industrial Development Districts Act known as the Industrial Facilities. Notice of New Sales Tax Requirements for Out-of-State Sellers. The Exempt and Taxable Purchases book includes.

Our Michigan sales tax book educates and identifies manufacturers on the states sales tax exemptions and associated requirements. Our training system set. Identifying Michigans manufacturing sales tax exemptions and taxable purchases are the most important elements of sales tax training.

The Michigan sales and use tax exemptions for both the agricultural industry and the industrial processing or manufacturing industry include such language. Machinery EXEMPT Sales of machinery are exempt from the sales tax in Michigan. Purchase the Sales Tax Exemptions.

This exemption claim should be completed by the purchaser provided to the seller.

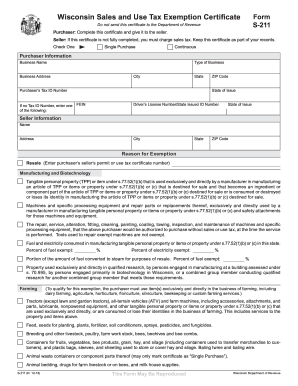

Wisconsin Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Form 149 Sales And Use Tax Exemption Certificate Missouri

Sales Tax Rates And Exemptions For Agricultural Manufacturing And Download Scientific Diagram

Five Hot Spots For Manufacturing Sales Tax Exemptions Cherry Bekaert

Utility Tax Studies Utility Sales Tax Exemption Experts

Ford S 2b Investment In Michigan Solidifies State S Auto Production Bridge Michigan

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

The Complete Guide To Managing Sales Tax Exemption Certificates

Utility Sales Tax Exemption National Utility Solutions Predominant Use Study Experts

Michigan State Resources Financial Incentives Tax Credits Business Taxes Contacts Area Development

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

2771f 2901 7 Michigan Gov Documents Taxes

The Complete Sales Tax Guide For Your Online Ppe Business

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller